Double declining method formula

Double Declining Balance Depreciation Method. Unlike double declining depreciation sum-of-the-years depreciation does consider salvage value when calculating depreciation so your first year depreciation calculation would be.

Double Declining Depreciation Efinancemanagement

What is the Double Declining Balance Depreciation Method.

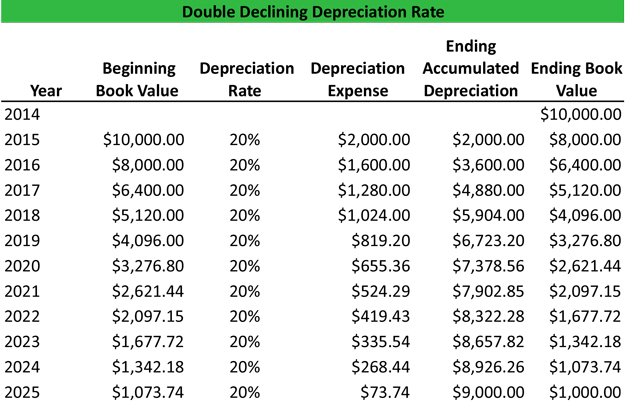

. French declining balance is an accelerated method of depreciation and may need to be plugged for the total amount of depreciation expense to equal the depreciable cost. An asset worth 10000 has a life of 5 years and its salvage value is 0 after five years. It is a method of distributing the cost evenly across the useful life of the asset.

We double-check all the assignments for plagiarism and send you only original essays. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2. Declining Balance Method.

In the above table it can be seen. To convert this from annual to monthly depreciation divide this result by 12. Wherein SLM Depreciation Rate 1 Useful life of the asset 100.

The boolean value TRUE as the last. DISCsettlement maturity price redemption day_count_convention. It represents the amount of value the.

We offer the lowest prices per page in the industry with an average of 7 per page. Which along with the definition shows that for positive integers n and relates the exponential function to the elementary notion of exponentiationThe base of the exponential function its value at 1 is a ubiquitous mathematical constant called Eulers number. Declining Balance Method Example.

Unit of production method if the machinery produces 16000 units in year 1 and 20000 units in year 2. The VDB variable declining balance function is a more general depreciation formula that can be used for switching to straight-line see below. Depreciation is calculated using the formula given below.

Declining Balance Method Example. Double-Declining Balance DDB Depreciation Method Definition With Formula The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a. We offer the lowest prices per page in the industry with an average of 7 per page.

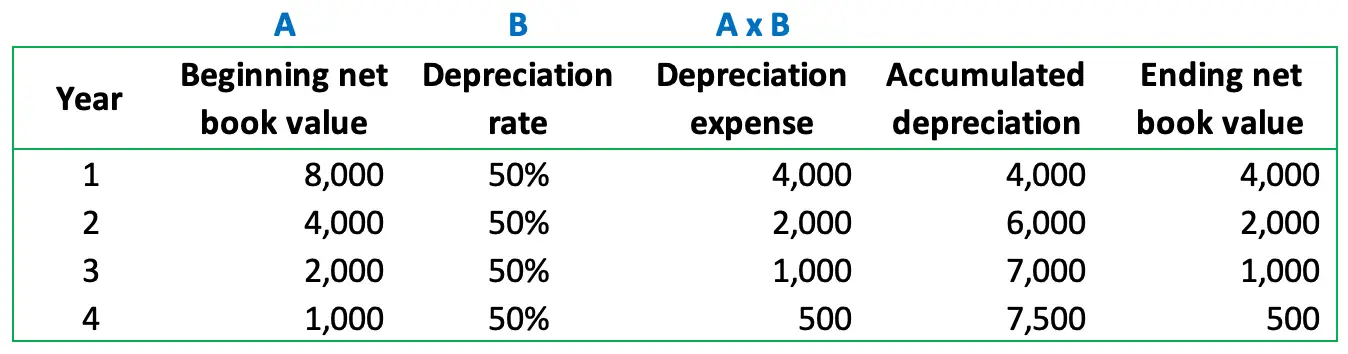

Chat With Your Writer. The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a depreciation rate. This involves accelerated depreciation and uses the Book Value at the beginning of each period multiplied by a fixed Depreciation Rate.

This guide will explain. While other continuous nonzero functions. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value.

10 55 x. We double-check all the assignments for plagiarism and send you only original essays. This method is commonly called the Double-Declining Balance Method because the depreciation rate that is used is usually double the straight-line rate or d2n.

Communicate directly with your writer anytime regarding assignment details edit requests etc. This is a convenient tool which you can also use after youve manually calculated the value using the double declining depreciation formula. Array_formula Enables the display of values returned from an array formula into multiple rows andor columns and the use of non-array.

Depreciation 2 X SLDP X BV. It can also calculate partial-year depreciation with any accounting year date setting. In the double declining balance Double Declining Balance In declining balance method of depreciation or reducing balance method assets are depreciated at a higher rate in the initial years than in the subsequent years.

The company in the future may want to allocate as little depreciation expenses as possible to help with additional expenses. The formula to calculate depreciation under SYD method is. Double declining balance method is a type of diminishing balance method in which the depreciation factor is 2X than the straight-line method.

Communicate directly with your writer anytime regarding assignment details edit requests etc. Formula for Double Declining Balance Method. The second is the double-declining depreciation method.

For the double-declining balance method the following formula is used to calculate each years depreciation amount. The following is the formula. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

Depreciation Asset Cost Residual Value Useful Life of the Asset. The basic formula to calculate depreciation using the double-declining method is. Written Down Value Method vs.

Double declining balance method. Double Declining Balance Method Formula. The most commonly used depreciation rate is 2X of the straight-line method known as a double-declining depreciation method.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. More Straight Line Basis Calculation Explained With Example. That satisfy the exponentiation identity are also known as.

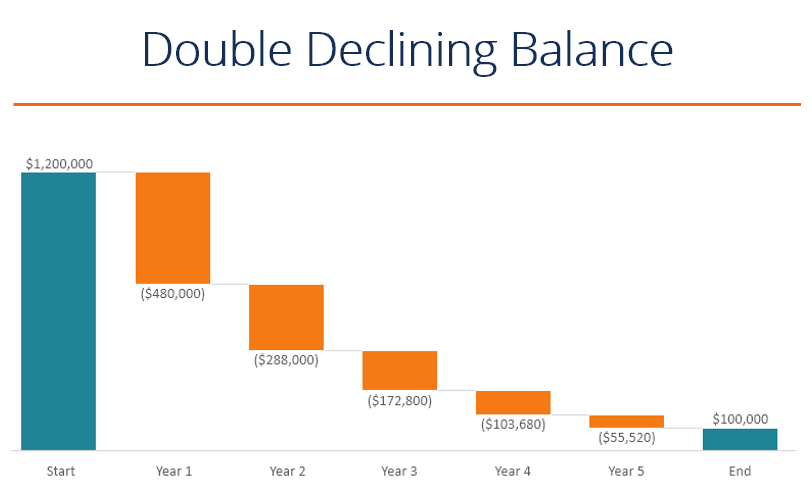

It is frequently used to depreciate fixed assets more heavily in the early years which allows the company to defer income taxes to later years. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. The formula for depreciation under the double-declining method is as follows.

Some companies or organizations also use the double-declining balance method which results in a large amount of depreciation expense. Lets understand the same with the help of examples. The formula for double-declining-balance depreciation is created in cell F8.

The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. Also discussed in the first paragraph of the article. Get the latest financial news headlines and analysis from CBS MoneyWatch.

Double Declining Balance Method formula 2 Book Value of Asset at Beginning SLM Depreciation rate. The double-declining-balance method is also a better representation of how vehicles depreciate and can more accurately match cost with benefit from asset use. Calculates the depreciation of an asset for a specified period using the double-declining balance method.

The first step in declining balance method is to calculate a straight line depreciation rate that is calculated using the following. Chat With Your Writer. The double declining balance method is simply a declining balance method in which double 200 of the straight line depreciation rate is used.

As stated in Section 1 you can manually adjust the depreciation expense or you can include. Straight Line Method of Depreciation One of the most common and popular types of WDV Method is the Double Declining Balance Method Double Declining Balance Method The Double Declining Balance Method is one of the accelerated methods used for calculating the depreciation amount to be charged in the companys income. A constant depreciation rate is applied to an assets book value each year heading towards accelerated depreciation.

Double Declining Balance Depreciation Calculator

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

What Is The Double Declining Balance Method Definition Meaning Example

Declining Balance Depreciation Double Entry Bookkeeping

Double Declining Balance Method Prepnuggets

Double Declining Balance Method Of Depreciation Accounting Corner

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Depreciation Daily Business

Calculate Double Declining Balance Depreciation Accountinginside

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Examples With Excel Template

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Depreciation Examples Guide

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Method Youtube

What Is The Double Declining Balance Ddb Method Of Depreciation